Fast forward a week, and let’s suppose the S&P 500 climbs to 3351. We ‘sell’ our position at the new bid price, ideally around 3350, netting us a 50-point gain. At $100 per point, that’s a tidy $5,000 profit, a 50% return on our initial $10,000 in just a week – a testament to the power of leverage in spread betting.

Recommended Sportsbook

However, if the market moves contrary to the trader’s position, losses may exceed the trader’s initial investment. Markets.com has a spread-only pricing model, meaning you don’t have to pay traditional trading commissions. Today, it is known for its competitive spreads, fast execution, and reliable platform. It’s important to ensure your Spread Betting Brokers provide complimentary resources such as analysis, education, and risk management tools.

Are online stock brokers safe?

To aid traders in their market analysis, they can also access a thorough economic journal and sophisticated charting tools. With many accolades to its name, CityIndex offers one of the most sophisticated trading platforms. The platform offers over 100 indicators as well as a huge range of drawing betting brokers and analytical tools, making it highly customizable. The City Index broker charges an inactivity fee if you fail to open a position for 12 months. There are also funding costs for leveraged positions held overnight. Plus, you’ll benefit from some of the highest minimum spreads on the market.

Best for Active Investors: Moomoo

75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. 75.2% of retail investor accounts lose money when trading spread bets and CFDs with this provider. 65.3%-75.2% of retail investor accounts lose money when trading spread bets and CFDs with these providers. It is one of the best-spread betting platforms for low and transparent fees.

Quick Look: Best Spread Betting Brokers

The best spread betting brokers do not have to pay interest on customer funds and, resultantly, gain a lot of interest. When customer accounts bear significant interest levels, the increasing deposits can often grow into millions for brokers. Pepperstone offer access to spread betting trading through TradingView, MT5, MT4 and cTrader.

How to spread bet on commodities example

Unlike contracts for difference (CFDs), commissions are not typically charged on spread bets so the primary cost to consider is the spread – the difference between the bid and ask price. Spread betting companies normally incorporate a fee for their services into the spread. Most regular bookmakers have a bad habit of limiting winning players.

How Are Spread Betting And CFDs Different?

Upon conclusion of each of our broker reviews, we have assigned each broker with a rating. You can choose from a wide range of products with 24-hour trading and spreads from 0.6 points on our more popular markets. Trade via your choice of trading platforms including a customisable desktop platform, tablet app or mobile app.

Beginner Friendly Spread Betting Brokers

Robinhood offers fractional share trading, which allows investors to buy and sell partial shares of stocks. As Cobra Trading advertises on its homepage, it can help you strike first, like a cobra, on trades. Cobra Trading is known for sophisticated trading tools and exceptional support to competitive day traders. The prices of bets in spreads are always quoted in pairs, meaning the selling price (bid) and the buying price (offer). As we mentioned earlier, leverage can potentially increase your profits and losses, as they are calculated using the full size of your trade—in this case, £113,220—and not just margin. For this, select the ‘Closed Status’ option in the status window.

Tradable Assets

Whether you’re interested in popular sports or niche events, our reviews give you the full picture of what each bookmaker has to offer. Spread betting arbitrage means opportunistically looking for discrepancies between pricing listed across different markets or platforms for the same asset or financial instrument. This allows you to buy an asset for cheaper and then immediately sell it at a profit – all at once. Think Markets is FCA-regulated and offers several different options. Think Markets uses its own software designs, but you will also find spread betting via Meta Trader 4 and Meta Trader 5 available here.

Best Sports Bet Brokers 2025 Top Betting Broker/Agent

In addition, Spreadex also covers traditional financial markets. You will have access to thousands of stocks, indices, currencies, and commodities. Another way brokers earn their interest is by banking on the interest on trader deposits.

XTB is a top choice for traders not just spread betting traders seeking in-depth market analysis, research tools and superior execution speeds on web, desktop and XTB trading mobile app. XTB offer a comprehensive education section for traders of all levels.Best suited for traders who value thorough market analysis and want to improve their trading skills. Therefore, choosing a platform that aligns with your trading goals is important. PremiumTradings is a reputable spread betting broker established by pioneers of online sports betting.

- Once you agree to the terms and conditions and submit the form, your account will be activated and ready to use.

- The outcome is uncertain and based on speculation, much like gambling.

- Nonetheless, only a tiny percentage of spread bettors succeed and the majority don’t.

- Especially if you’re just starting, having access to high-quality educational material can make a significant difference in your trading journey.

- Spread betting is a leveraged product, which means you can place a bet while only putting up a fraction of the full value of the position.

- It’s like a mix of investing and gambling, and it’s tax-free in some regions.

And remember, the costs, margins, and fees can differ big time between CFDs and spread betting. One of the main benefits of spread betting is that investors can trade with leverage, trading at greater exposure than their deposited amount. Leverage in this context refers to the extra money an investor has access to when they execute a trade.

Spread betting has significant tax advantages compared to other trading and investing activities. Winnings from stock, forex, and CFD trading are subject to UK capital gains tax, but winnings from betting are not subject to UK capital gains tax. This is because it is legally considered gambling rather than an investment.

Is spread betting legal in the United States?

IG nonetheless offers a safeguard to stop you from making a loss that goes over your account balance, if you activate their option which is called Negative Balance Protection. Short-term speculation on the market is always a volatile way to trade. Even professional day traders generally make money over the long term, by making small gains, rather than making any single big win. In this context, it means a significant advantage or disadvantage. We are able to leverage a very small investment to potentially get much bigger returns or much bigger losses.

Best Trading Brokers

- Do not overestimate your position, though, as doing so could result in hefty losses.

- Take advantage of the demo feature to explore different strategies and learn the world of spread betting in a risk-free environment.

- The big bookmaker comparison at transfermarkt.com/betting reveals which bookmaker is the number one based on multiple factors.

- At first glance, Premium Tradings looks impressive – but we do need to look into it some more before we can bring a full review.

- Now, having been in the financial trading game for a couple of decades, I’ve seen the landscape evolve tremendously.

- The bet broker earns money on the turnover of players referred by him to bookmakers, simply receiving a percentage of the margin imposed on the odds.

- IC Markets and Roboforex collaborate with top analysts to bring the most up-to-date news and insights to traders.

Summarizing the previous few points in part, it is easy to see that a single account with a bet agent will replace multiple accounts with bookies, as well as tools or websites. The main account at the broker is, in a sense, our betting command center. One account also means one user verification, which is not objectionable. Certainly for people who like to have everything arranged, the solution offered by bet brokers has its great advantages. From our investigations, most platforms offer spread bets on stocks, indices, forex and commodities.

- For those who prefer to complete everything at once, full registration lets you enter all personal details immediately, which may take a little longer.

- In summary, we get powerful tools that we won’t get access to anywhere else, and how we use them, what our needs are and what we do with it is already an individual decision of each player.

- It allows you to place trades that will only pay off if the market moves in your favour.

- 75.2% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

- Markets.com has a spread-only pricing model, meaning you don’t have to pay traditional trading commissions.

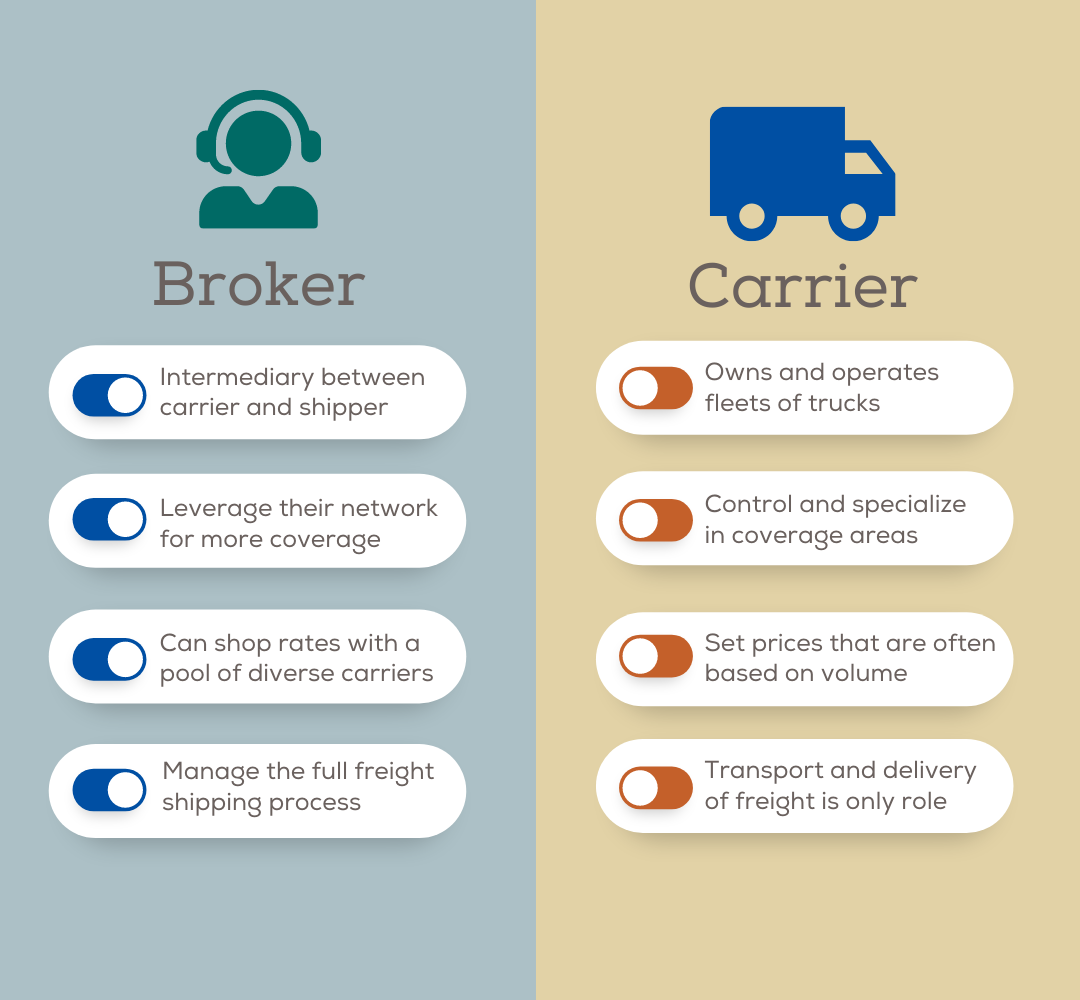

- Also called a sports betting broker, a betting agent is a middleman between a bettor and a betting site.

Spread betting is where you can place speculative bets on how the price of a financial instrument will move up or down. You are not buying or selling underlying financial assets when spread betting, your spread bet speculation is with your broker. In this example, spread betting allowed us to capitalize on market movements with a relatively small initial investment, magnifying both potential gains and losses. It’s a strategy that demands respect for market volatility and an unwavering discipline in risk management. For veterans and novices alike, it’s a powerful tool when wielded with wisdom and caution.

Best Spread Betting Brokers: A Buying Guide for You

Robinhood is known for providing easy access to the markets for all investors. It allows traders to buy and sell stocks without commission charges. It features a quality mobile app that is simple, intuitive and easy to learn.