Articles

- Pay mobile casinos | Appendix B—Tax Treaty Exemption Process of Coaches and Scientists

- Whenever discussions along with your property owner wear’t performs: Going to court

- You Players Are able to use Cryptocurrency

- Dining table dos-step one. Overview of Resource Legislation to have Money of Nonresident Aliens

- Manage your account

Another camp includes individuals who’ll feel free to attempt to twice the fiver to the a keen even-money pay mobile casinos roulette wager or for the black-jack. And they’ll both return to to experience pokies using their $10 or try to victory some more moments inside a great line. Debit card dumps sound simple but they always carry a good fee, elizabeth.g. dos.5%, once you create a withdrawal.

A final payment out of payment inside the income tax year to have separate personal functions could be completely or partially exempt out of withholding. It exemption (will not apply to earnings) can be acquired only when during your taxation 12 months and you can applies to a total of $5,one hundred thousand of settlement. To locate which exclusion, your otherwise their broker need give the following the statements and you may guidance to the Commissioner otherwise Administrator’s outsource. Info you will get inside 12 months for functions did on the You is subject to U.S. income tax.

Pay mobile casinos | Appendix B—Tax Treaty Exemption Process of Coaches and Scientists

“On-campus work” form functions did on the school’s site. On-university functions boasts work did at the a from-university place which is educationally affiliated with the school. On-campus functions under the regards to a scholarship, fellowship, or assistantship is recognized as area of the educational system out of an excellent pupil getting the full course of research that is permitted by the the brand new USCIS. Personal protection and Medicare taxes are not withheld from pay money for it functions except if the fresh student is regarded as a citizen alien.

Whenever discussions along with your property owner wear’t performs: Going to court

Projected tax paid back by the one prior to death have to be stated to the tax come back filed to the decedent rather than to your Form 541 submitted on the decedent’s house. Enter the amount of people estimated taxation percentage the new property otherwise believe generated on the Form 541-Es for 2021. As well as, go into the level of one overpayment from the 2020 taxation come back which had been placed on the fresh 2021 projected tax.

You Players Are able to use Cryptocurrency

If you document the return more than 60 days following the due date or lengthened deadline, minimal penalty ’s the smaller from $510 or 100% of your own delinquent income tax. Unless you document your own get back from the deadline (as well as extensions), you may have to spend faltering-to-document punishment. The new penalty will be based upon the newest taxation maybe not paid off from the deadline (as opposed to regard to extensions). The fresh punishment is usually 5% for each day otherwise part of 30 days one to a return are later, yet not more than twenty five%. If you don’t document your own return and you may spend your taxation because of the due date, you may have to pay a penalty.

Document Form 541 and you may spend some the funds and you may write-offs where there try a california citizen fiduciary or citizen non-contingent beneficiary. Understand the Plan Grams recommendations for the web page 15 to find out more. To learn more get Mode 541-B, Charity Sleep and you can Pooled Earnings Trusts. Company Borrowing from the bank Limit – To own nonexempt many years delivery for the or just after January 1, 2020, and you may ahead of January step one, 2023, there is certainly a good $5,000,000 restriction on the application of company credit to have taxpayers. The entire of all team loans for instance the carryover of any business borrowing on the taxable year may not reduce the “net income tax” by more than $5,100,one hundred thousand. Company credits is going to be used facing “net tax” before almost every other loans.

Dining table dos-step one. Overview of Resource Legislation to have Money of Nonresident Aliens

The newest Relaxed Savings account features a great $10 fee every month which can be waived for individuals who meet one to from four standards. Two of those requirements are maintaining a great $five-hundred minimum every day equilibrium or getting $five-hundred or maybe more overall being qualified head dumps for each and every period. Which KeyBank bank account added bonus is big – score $300 to own starting both a key Wise Checking to your minimal beginning deposit of $ten and another qualified direct put of at least $step 1,100000 within the very first two months out of membership starting.

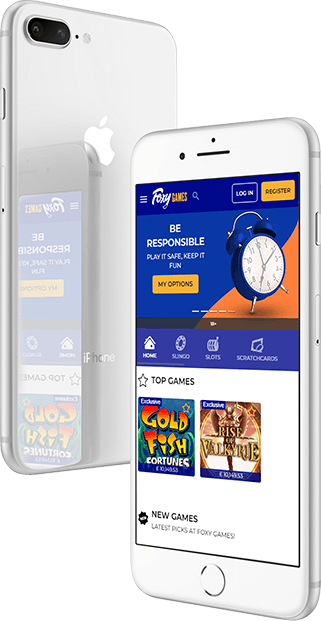

Manage your account

When you yourself have questions associated with all the information within the new translation, reference the brand new English adaptation. The newest Roentgen&TC and you can associated legislation don’t discuss the state where particular fiduciaries and several beneficiaries is actually nonresidents (problem 5). Report sales of products that would-have-been at the mercy of conversion tax in the event the ordered away from a california retailer except if the acknowledgment reveals you to California taxation are paid straight to the merchant.